Is Service Revenue On The Balance Sheet

What is Unearned Revenue?

Unearned revenue is the number of accelerate payments which the company has received for the appurtenances or services which are still pending for the delivery and includes transactions like Corporeality received for the goods commitment of which is to be made on the futurity appointment etc.

Information technology is a category of accrual nether which the company receives cash before it provides goods or renders services. Under this, the substitution happens before actual goods or service commitment, and as such, no revenue is recorded by the company. The company, nevertheless, is under an obligation to provide the goods or return the service, as the example may be, on due dates for which advance payment has been received past information technology. Equally such, the Unearned Acquirement is a Liability Unearned acquirement refers to the advance payment amount received past the visitor confronting goods or services awaiting for delivery or provision respectively. Information technology is the company's liability since the amount has been caused for the goods or service which the company had not yet provided. read more till the fourth dimension it doesn't completely fulfill the same, and the amount gets reduced proportionally as the business is providing the service. Information technology is also known past the name of Unearned Income, Deferred Revenue Deferred Revenue, also known as Unearned Income, is the advance payment that a Visitor receives for goods or services that are to exist provided in the future. The examples include subscription services & advance premium received by the Insurance Companies for prepaid Insurance policies etc. read more , and Deferred Income every bit well.

You are free to utilise this image on your website, templates etc, Please provide us with an attribution link Article Link to exist Hyperlinked

For eg:

Source: Unearned Acquirement (wallstreetmojo.com)

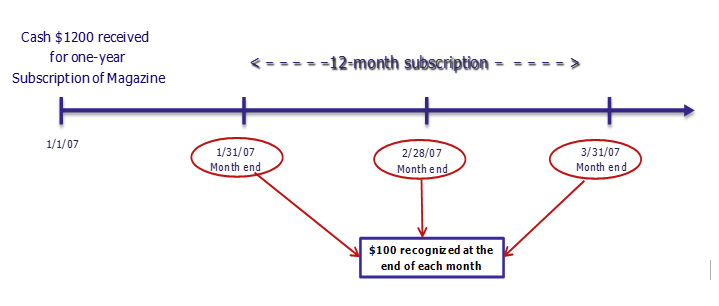

The most basic example of unearned revenue is that of a magazine subscription. When nosotros register for an almanac subscription of our favorite magazine, the sales received past the visitor is unearned. As they evangelize magazines each month, the company keeps on recognizing the corresponding income in the income statement The income argument is one of the company'due south financial reports that summarizes all of the company's revenues and expenses over time in order to make up one's mind the visitor's profit or loss and measure its business activeness over time based on user requirements. read more .

Unearned Revenue is a Liability on the Balance Canvas

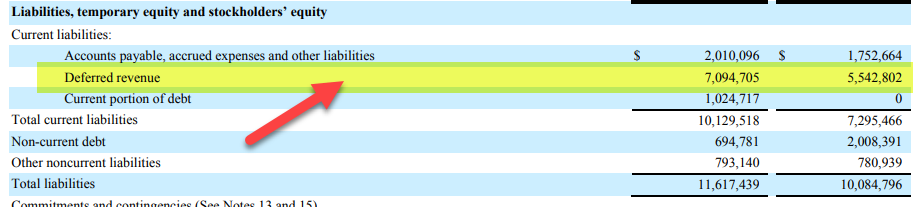

Usually, this unearned revenue on the residuum sheet A residue sail is ane of the fiscal statements of a company that presents the shareholders' equity, liabilities, and avails of the company at a specific indicate in time. It is based on the accounting equation that states that the sum of the full liabilities and the owner'south upper-case letter equals the total assets of the company. read more is reported undercurrent liabilities Current Liabilities are the payables which are likely to settled inside twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc. read more . Yet, if the unearned is non expected to be realized as actual sales, then information technology tin can be reported every bit a long-term liability.

As an example, we note that Salesforce.com reports unearned revenue every bit a liability (current liabilities).

source: Salesforce SEC Filings

Salesforce Example

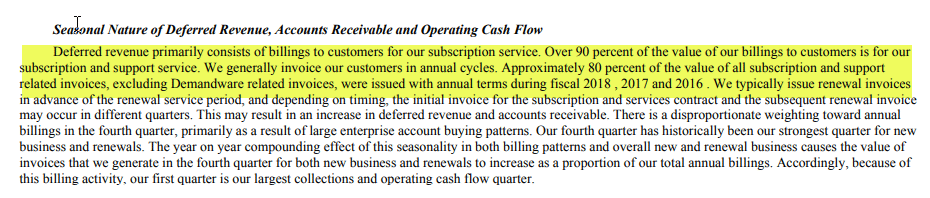

Acquirement in Salesforce consists of billing to customers for their subscription services. Most of the subscription and support services are issued with annual terms resulting in unearned sales.

source: Salesforce SEC Filings

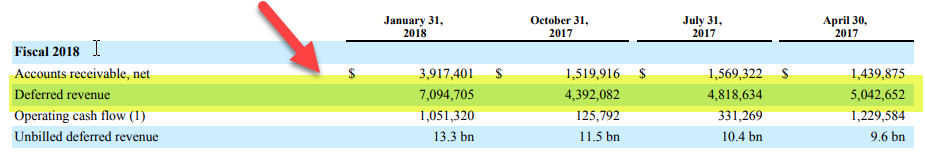

Unearned sales are virtually meaning in the January quarter, where most of the large enterprise accounts buy their subscription services.

source: Salesforce SEC Filings

Unearned Revenue Accounting

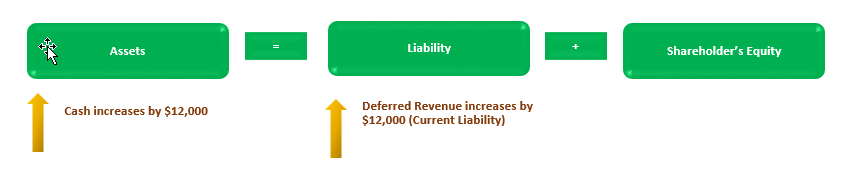

When a company receives cash for the appurtenances or services that information technology will provide in futurity; it leads to an increase in Cash Balance of the company, since the appurtenances or service is to be provided in future, the Unearned Income is shown as a Liability in the Balance Sail of the company which resulted in a proportional increase on both sides of the Residuum Sheet (Asset and Liabilities). Let the states at present look at how bookkeeping works.

Suppose company XYZ pays $12,000 for a maintenance and cleaning contract to company MNC for 12 months. How will MNC tape this unearned sales acquirement on the Remainder Sheet

| Account | Debit | Credit |

|---|---|---|

| Cash | $12,000 | |

| Deferred Revenue | $12,000 |

Information technology will look similar

You are complimentary to use this paradigm on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Unearned Revenue (wallstreetmojo.com)

At present, after working for a calendar month, MNC has earned $ 1000, i.e., it has provided its services to XYZ; thus it will accrue its earning

| Account | Debit | Credit |

|---|---|---|

| Deferred Revenue | $1,000 | |

| Service Revenue | $1,000 |

Hence, $ m of unearned income will be recognized as service revenue. Service acquirement will, in plow, affect the Turn a profit and Loss Account in theShareholders Disinterestedness section Shareholder'south equity is the residual interest of the shareholders in the visitor and is calculated as the divergence between Assets and Liabilities. The Shareholders' Equity Statement on the balance sheet details the modify in the value of shareholder'due south equity from the beginning to the end of an accounting period. read more .

You lot are free to utilise this epitome on your website, templates etc, Please provide u.s. with an attribution link Article Link to be Hyperlinked

For eg:

Source: Unearned Revenue (wallstreetmojo.com)

It is essential to sympathise that while analyzing a company, Unearned Sales Revenue should be taken into consideration equally it is an indication of the growth visibility of the business concern. Higher Unearned income highlights the strong order arrival for the company and besides results in good liquidity for the business as a whole. Furthermore, unearned income doesn't result in cash outflow in the future as merely Unearned Sales Revenue, a liability, on the Unearned Sales Revenue Balance Canvas, is reduced as acquirement is recognized on providing the goods or services proportionately.

Popular Industries where Deferred Acquirement is common includes Airline Industry (tickets booked by the customer in advance), Insurance Industry (Insurance premium is e'er paid in advance), Legal Firms (Legal retainer paid in advance), and Publishing Firms (subscription paid in advances) such as Magazine, etc. An airline Industry unremarkably receives the advance payment of tickets booked past customers. Still, the actual service (the travel engagement) typically happens at a later on engagement, and such industries are required to report the aforementioned in the Financial Statements Financial statements are written reports prepared by a company's direction to present the company's fiscal affairs over a given period (quarter, half dozen monthly or yearly). These statements, which include the Balance Canvas, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more equally per the methods discussed henceforth.

Ii Types of Unearned Sales Acquirement Reporting

#1 – Liability Method

Under this method, when the business concern receives deferred Revenue, a liability account is created. The bones premise backside using the liability method for reporting unearned sales is that the corporeality is however to be earned. Till that time, the business organization should report the unearned revenue every bit a liability. The mutual liability account used in the Deferred Revenue etc.

#2 – Income Method

Under this method when the business receives unearned sales, the whole amount received is recorded under an Income account and proportionately adapted as the goods or service is delivered by the business organization over the menses of time as goods or service is provided.

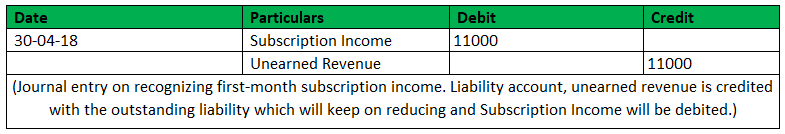

Journal Entries

Let's understand the two types of unearned sales reporting through examples of Unearned Revenue Journal Entries Unearned Acquirement refers to money that has been received but has yet to be delivered in the form of appurtenances or services. Information technology cannot be considered as revenue until the goods or services are delivered, according to the revenue recognition concept. Therefore it is treated equally a electric current liability. read more :

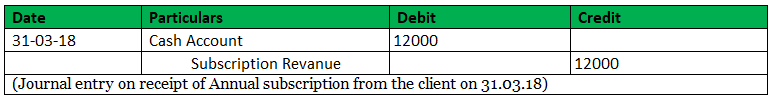

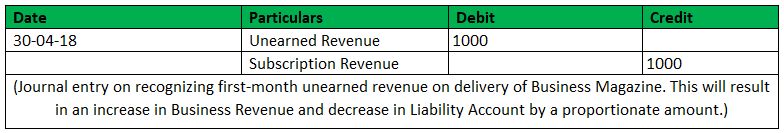

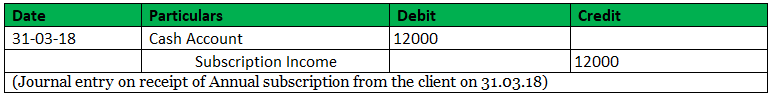

ABC is in the business of publishing Concern Magazine. The visitor receives an almanac subscription of Rs 12000 from ane of its clients on 31.03.2018 for the adjacent year. Acquirement will exist earned when the magazine will exist delivered to the customer monthly. Rest Sheet as on 31.03.2018 volition show an increase in Cash Balance past the amount of almanac subscription of Rs 12000 and Unearned Income, a liability, volition be created. The said liability will subtract past the proportional amount of Rs 1000 on 30.04.2018 when ABC delivers the beginning installment of Business Mag to its client. Accordingly, ABC limited volition evangelize the remaining Business concern Magazine to its client month on calendar month, and the same will upshot in Acquirement Recognition. At the end of the year, on 31.03.2019, Deferred Acquirement, a liability volition terminate to exist, and all revenue will exist recognized in the Income Statement of ABC Limited.

Periodical Entry nether Liability Method

Journal Entry under Income Method

Unearned Sales results in cash exchange earlier revenue recognition for the business. Nonetheless, if a business does not follow the right accrual method of recognition of Deferred Revenue, information technology can overstate the revenue and resultant profitability without recognizing the corresponding expenses to generate such revenue. Furthermore, that will besides lead to a violation of the Matching Principle of accounting for unearned income, which requires that both expense and related income should be reported in the same period to which it belongs.

Unearned Revenue (Sales) Video

Recommended Manufactures

This article has been a guide to what is unearned revenue and its definition. Here we discuss how to business relationship for unearned revenue on the balance canvas along with examples and periodical entries. You may also have a look at these related articles on Basic Accounting –

- Principle of Revenue Recognition

- LTM Revenues Meaning

- Revenue vs. Sales

- Revenue Reserve vs. Capital Reserve

Is Service Revenue On The Balance Sheet,

Source: https://www.wallstreetmojo.com/unearned-revenue/

Posted by: smithdreir1948.blogspot.com

0 Response to "Is Service Revenue On The Balance Sheet"

Post a Comment